Strategy and targets

Sustainable profitable growth as an expert in photonics

Global megatrends offer growth opportunities for Jenoptik

With the new Agenda 2025 “MORE VALUE” Jenoptik is focusing on sustainable profitable growth in photonic core markets

By focusing on photonic growth markets, we want to develop Jenoptik into a globally positioned photonics company. We have largely completed this transformation, creating strong growth platforms. For the remainder of the strategy period, our main priorities for the implementation of Agenda 2025 are organic growth, operational excellence, innovation, and customer focus.

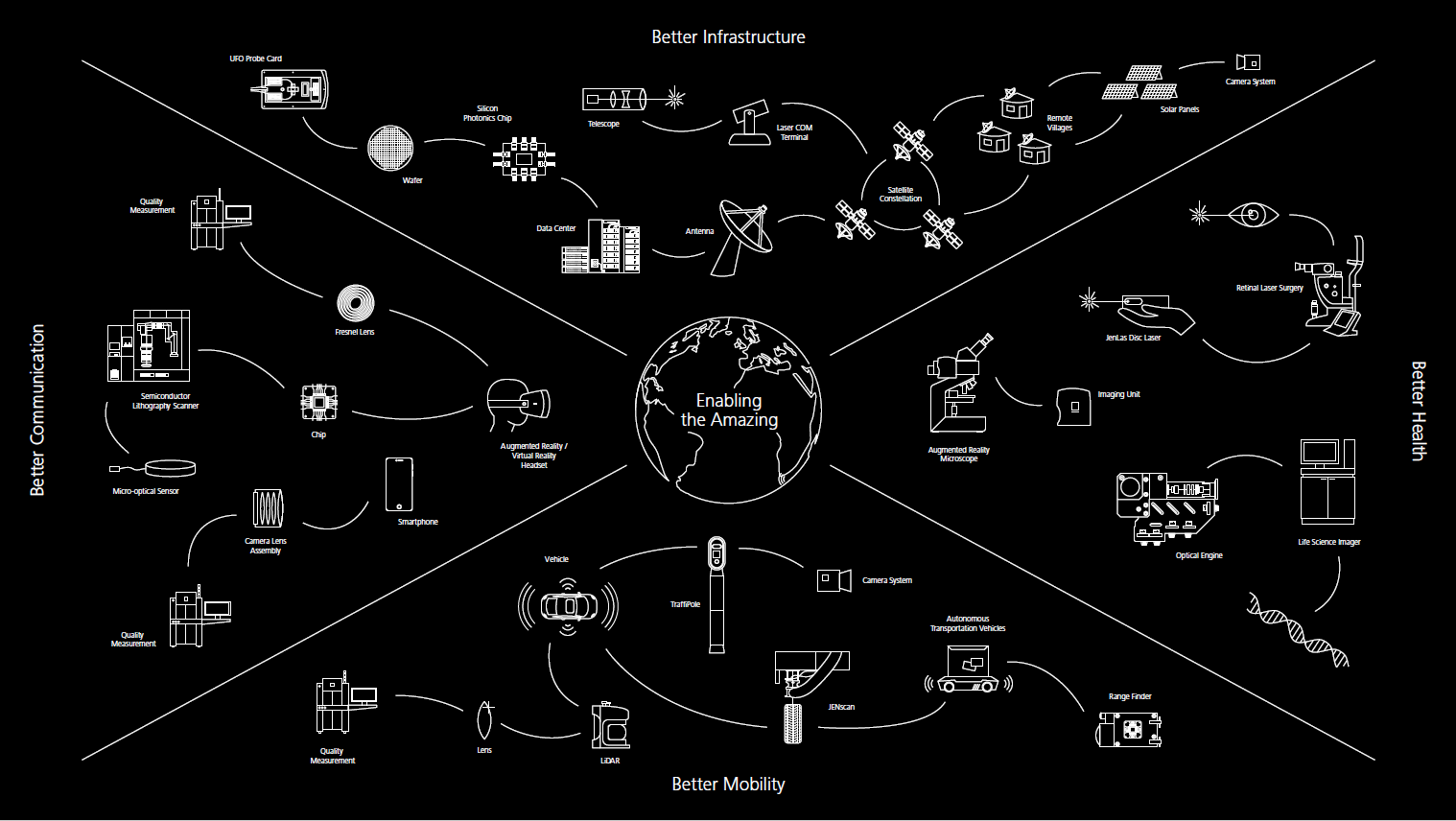

The core of the "More Value" agenda is to focus Jenoptik's technological expertise on the three high-growth future markets of semiconductor & electronics, life science & medical technology as well as smart mobility. As an “enabler”, the company can create significant added value (“More Value”) for all stakeholders – e.g. customers, employees, and shareholders – with its photonic solutions, aiming for above-average growth and increasing profitability. For us, entrepreneurial activity is closely linked to our commitment to the environment and society.

Goals 2026

Forecasted revenue

~ 1.2 bn euros

EBITDA margin

21-22 %

ROCE > WACC

More information on our Agenda 2025 "MORE VALUE" is available in the presentation from the 2021 Capital Markets Day.

Objectives of Agenda 2025 “MORE VALUE”

- Transform Jenoptik into a globally leading pure photonics group

- Focus on three highly attractive growth markets: semiconductors/electronics, life sciences/medical technology and smart mobility

- Accelerate organic and non-organic growth

- Further increase profitability

- Strengthen financial firepower for organic growth and further acquisitions

Our photonic core markets

Video: Enabling the amazing

In implementing our Agenda 2025 “MORE VALUE,” we rely on:

Digitization and innovation

As an innovative, high-tech company, it is essential for Jenoptik to identify future customer needs and trends at an early stage in order to derive corresponding technology and product developments from them. With our know-how and innovative products, Jenoptik, as an enabler, makes an important contribution to overcoming societal challenges and enables our customers to contribute more efficiently and sustainably to more resource conservation and climate protection.

Sustainability strategy

Sustainability is an integral part of our corporate strategy. Our sustainability targets are taken into account in the Executive Board remuneration and are incorporated into our group financing.

Operational excellence

With the introduction of the new Jenoptik Business System, we are supporting the implementation of our Agenda 2025.

Human Resources Management

The commitment and know-how of our employees worldwide is the key to Jenoptik’s success and sustainable growth.

Guidance

“In a market environment that continues to be characterized by macroeconomic and political developments that are difficult to predict and thus by considerable uncertainty, we are optimistic that we will return to growth in 2026 thanks to our strong growth platforms in the core markets of semiconductors, life science & medical technology, measurement technology and smart mobility. This is supported by improved demand at the beginning of this year,” comments Dr. Prisca Havranek-Kosicek, Chief Financial Officer of JENOPTIK AG.

With regard to the important semiconductor equipment industry, a fundamentally positive development is expected, based in part on the announced massive investments in data centers. The Executive Board expects Jenoptik to achieve both an increase in revenue and an improvement in EBITDA margin in the current fiscal year.

A quantitative guidance for the fiscal year 2026 will be presented as part of the publication of the final and audited figures for 2025 and the 2025 Annual Report on March 25, 2026.

The forecast is subject to the assumption that the political and economic environment does not deteriorate. Possible portfolio changes are not taken into account in this forecast.

as at February 2026